Меня очень часто спрашивают о том, в какой букмекерской конторе я предпочитаю делать ставки и я всегда отвечаю про Мостбет, и это не просто так. В статье ниже, вы узнаете о том, как попасть на зеркало Mostbet рабочее на сегодня и что это такое, как скачать приложение Mostbet, чем этот сервис лучше остальных и в чем различие между ru и com версий. В общем, после прочтения этого материала, у вас не должно остаться вопросов по поводу выбора букмекера, так что начинаем!

Mostbet зеркало официального сайта

Ах да, чуть не забыл — попасть на официальный сайт Мостбет просто так не выйдет. Вы не можете написать название букмекера в своем поисковике и перейти по первой же ссылке, ведь их сайт заблокирован. Чтобы обойти запрет, нужно использовать зеркало Мостбет.

Для того, чтобы воспользоваться им прямо сейчас, просто нажмите на кнопку выше и начнется автоматический переход на тот самый официальный сайт Mostbet, где можно будет приступить к регистрации своего аккаунта.

Как выглядит зеркало Mostbet?

Зеркало букмекерской конторы Mostbet выглядит как та самая кнопка вверху, но на самом деле, это обычная ссылка. Вся суть заключается в том, что у этой ссылки изменен домен. Можете просмотреть при переходе на нее на урл, и там будут непонятные символы. Это сделано специально, ведь РКН на постоянной основе блокирует адреса букмекера. Более того, блокируются даже новые зеркала, и приходится прибегать к таким действиям.

Так как измененного домена сайта еще нет в списке запрещенных — никто не сможет запретить нам переходить на сайт, а как только мы пополи на главную страницу, то можем перейти к созданию своего профиля, или войти в аккаунт, если таковой имеется.

После входа в свой аккаунт, я получаю доступ к личному кабинету Mostbet, в котором содержится такой функционал:

- Возможность изменить персональную информацию о себе;

- Настройка безопасности аккаунта;

- Инструменты для пополнения счета и вывода средств с конторы;

- Информация об акциях и бонусах, которые доступны на сайте;

- Кнопка для связи с оператором букмекерской конторы.

Обратите внимание, что даже несмотря на изменение ссылки, вы все равно совершаете переход на официальный сайт Мостбет. Так что, можете не переживать за создание аккаунта здесь, ведь он будет доступен и по другим ссылкам на сайт букмекера.

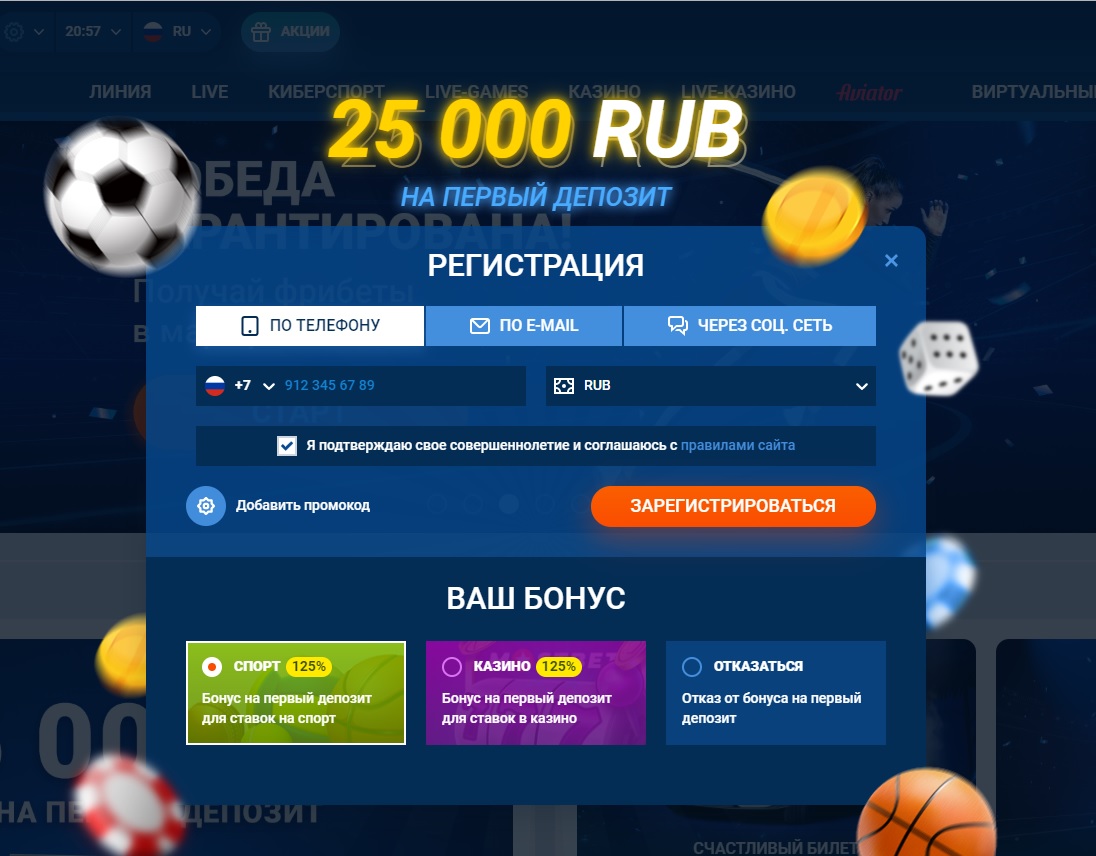

Бонус Mostbet 25000 рублей + 250 бесплатных вращений

Для стимуляции регистрации на сайте, букмекер использует бонусы. К примеру, на данный момент работает акция, при которой можно получить 25 000 рублей после регистрации. Все, что нужно сделать — создать аккаунт и сделать пополнение счета. В зависимости от того, на какую сумму будет пополнен счет в первый раз, то столько же вы получите в качестве бонуса, но до 25 000 рублей.

Помимо этого, такой же бонус можно получить для игры в казино. Но если вы хотите взять именно его, то отметьте выбор бонус казино Mostbet при регистрации в форме заполнения данных, так как там по умолчанию действует акция на спортивные ставки. В случае с казино, каждый игрок также получает бонус на первый депозит и 250 фриспинов (бесплатные вращения).

Если вы думал, что на этом щедрость букмекера заканчивается, то сильно ошибаетесь. Ей нет конца и края, и чтобы поверить в это, перейдите в раздел акций на сайте. Здесь вам будут предложены бонусы на депозиты, фрибеты, страховки ставок, розыгрыши призов и даже собственная программа лояльности.

Промокод

Заработать 25 000 рублей за простую регистрацию и пополнение счета очень легко, и можно сказать большое спасибо зеркалам букмекера за такую возможность. Однако, мало кто из вас знает, что используя промокод Мостбет, размер бонуса можно увеличить.

Более того, при его использовании, бонус от Mostbet составит 150% от первого депозита, а это значит, что вам нужно будет пополнить счет на меньшую сумму, чтобы воспользоваться максимум от этой акции.

Взять активный промокод можно прямо сейчас на этом сайте, а вводить его нужно при регистрации аккаунта, и сейчас мы более подробно рассмотрим, как это делается.

Регистрация на сайте и вход Мостбет

Регистрация в Мостбет зеркало точно такая же, как и на других подобных сервисах. Все, что вам требуется — номер телефона, почта и 2 минуты свободного времени. Впрочем, можно пройти эту процедуру в 1 клик, и система само подберет удобные для вас логин и пароль. Кстати, здесь доступно сразу несколько вариантов создания профиля, и среди них можно выбрать:

- Регистрация по номеру телефона — вводите свой номер телефона и на него присылается смс с кодом для подтверждения создания своего профиля на сайте. Также, нужно будет выбрать свою страну и валюту счета (если не хотите играть рублями, то без проблем можете выбрать евро, доллары, да хоть азербайджанские манаты);

- По E-mail — вводите адрес электронной почты и указываете минимум персональной информации о себе. На почту придет письмо, в котором будет ссылка. Перейдя по ссылке, вы активируете свой аккаунт и сможете приступить к использованию сервиса.

- Через социальные сети — если нет времени или желания вводить номер телефона с почтой, то просто войдите в свой аккаунт Вконтакте, Одноклассниках Google или другого варианта, который предложит букмекер.

Обратите внимание, что в этой форме заполнения данных, напротив кнопки зарегистрироваться есть пункт — добавить промокод. Нажав сюда, вы сможете вставить заранее скопированный промокод от нас, чтобы получить увеличенный бонус.

Мостбет — обзор букмекерской компании

Mostbet.com (Мостбет) – это международная букмекерская контора, которая уже давно стала мировым брендом и компанией номер один в большинстве стран мира. Компания широко известна в России, Азербайджане, Узбекистане, Украине, Казахстане, а также в Европе, Индии и даже Латинской Америке.

Для того, чтобы работать в таком большом количестве стран, букмекер прошел лицензирование в Кюрасао. Это подтверждает тот факт, что букмекер полностью безопасен для игры с ним, и тут будут гарантии выплаты выигрышей. Ну и важно учитывать тот факт, что сервисом пользуется огромное количество людей, и они очень сильно благодарны компании за возможность зарабатывать большие деньги.

Возможность заработать здесь действительно есть. Это связано не только с большим количеством бонусов, на которых можно стабильно зарабатывать, но и с выгодными коэффициентами, линией и росписью матчей, в чем можете убедиться самостоятельно прямо сейчас.

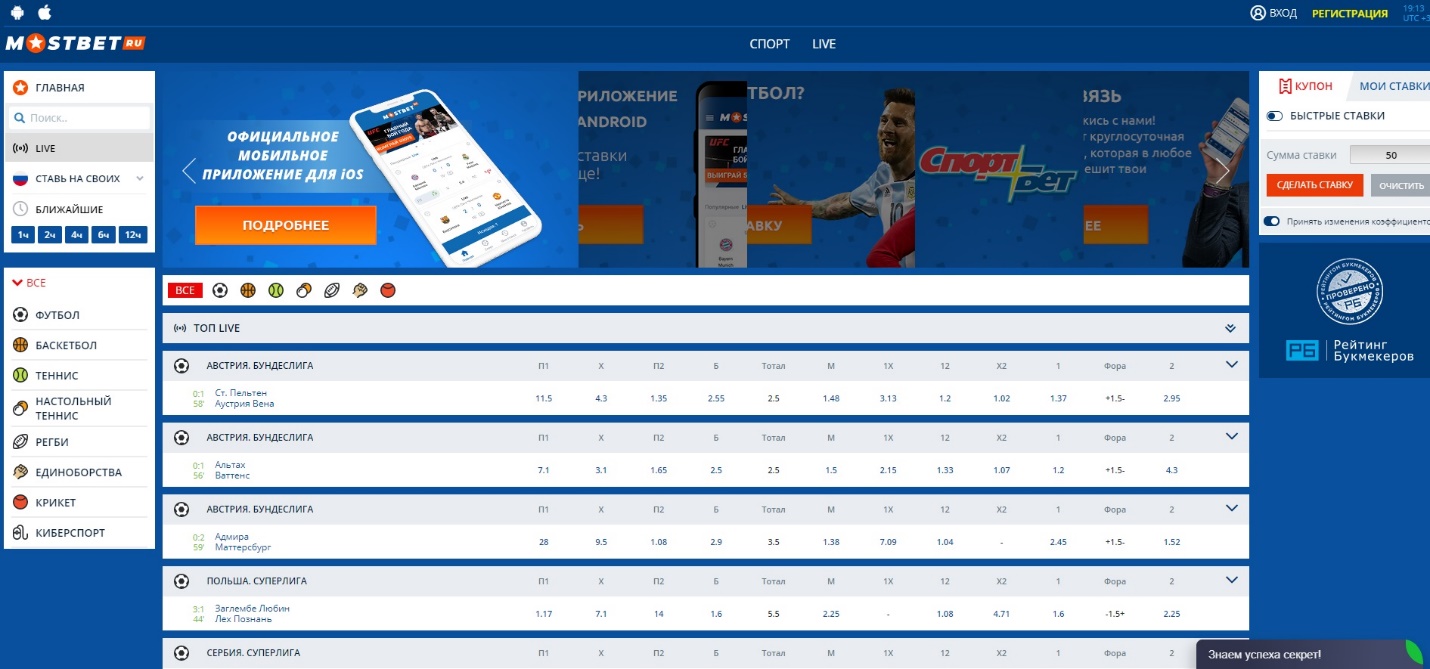

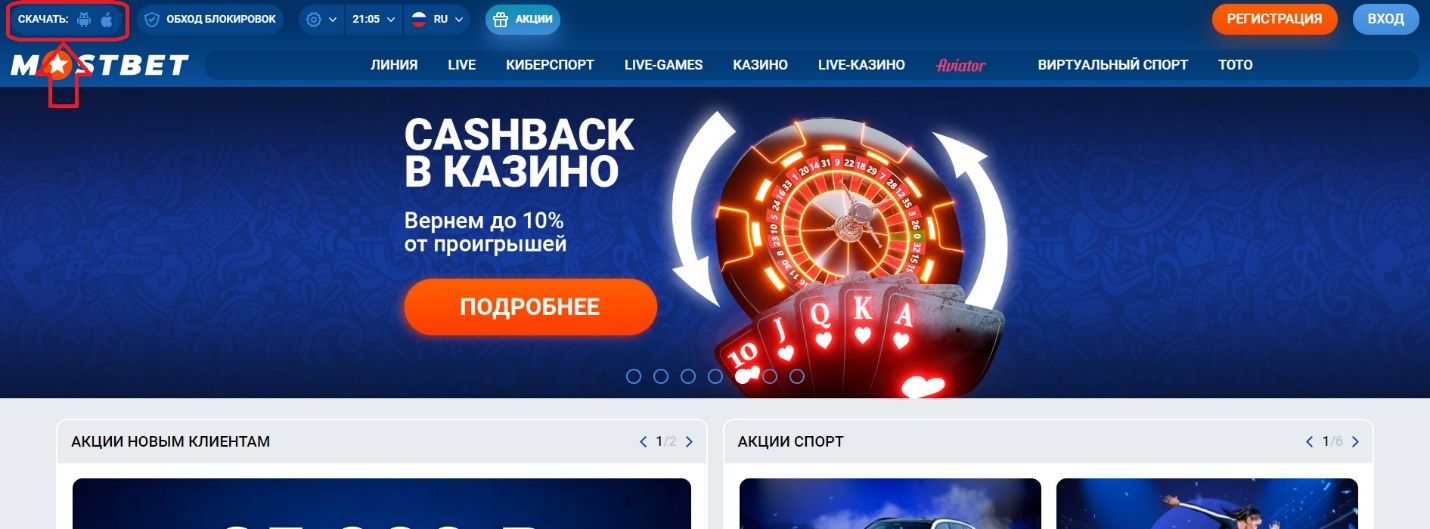

Официальный сайт Mostbet

Если вы очень сильно зацикливаетесь на дизайне официального сайта букмекерских контор, то вряд ли вы сможете придраться к Mostbet. Сайт выполнен в очень приятном и ярком дизайне, что изначально настраивает на хорошее настроение и позитивный беттинг.

К тому же, букмекеру удалось наладить идеальную навигацию. Найти нужный раздел на сайте сможет даже тот человек, который никогда не делал ставок на спорт.

Также, стоит отметить функциональность главной страницы, ведь здесь:

- Можно изменить языковую версию сайта на 10 других версий;

- Возможность ставить с самыми разными валютами мира;

- Официальный сайт позволяет использовать видеотрансляции;

- На каждый матч предлагается матч-центр и раздел статистики;

- Можно следить за движением линий;

- Коэффициенты отображаются в режиме реального времени.

Плюсом станет и то, что сайт работает как швейцарские часы, и за все время использования, у меня никогда не было проблем с заключением пари или неправильным расчетом ставки.

В чем отличие mostbet.com и mostbet.ru?

Кстати, пришло время разобраться с вопросом, который интересует большинство пользователей в интернете — а в чем отличие международной версии сайта от российской? Да, у компании действительно два сайта, и если вбить Мостбет в поисковике, то вы сразу же перейдете на страницу легальной версии.

Однако, я не рекомендую туда вообще заходить, ведь делать там нечего. Букмекер уже давно бросил заниматься данным сайтом и сейчас там доступно только две кнопки — линия и лайв. Никаких бонусов за регистрацию, и уж тем более на топовые спортивные события здесь не будет. Высокий размер маржи убивает коэффициенты, а если получится заработать, то вас попросят заплатить налог на выигрыш. Согласитесь, что это является такой себе перспективой.

Исходя из этого, единственное что нам нужно сделать — забыть про российскую версию, у которой якобы главное преимущество заключается в легальном статусе и переходить в оффшор, где нет подобных ограничений.

В общем, вы поняли, что ставить можно только на оффшоре, но как раз-таки из-за этих проблем с лицензией и законами, данная страница заблокирована и по этой причине, нам приходится использовать зеркало Mostbet каждый раз, чтобы попасть на сайт и начать делать ставки.

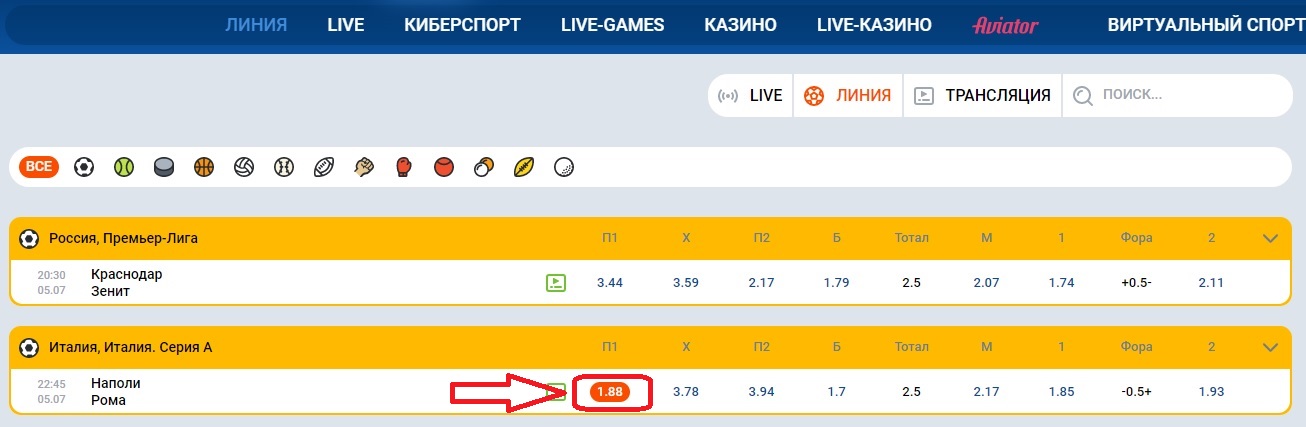

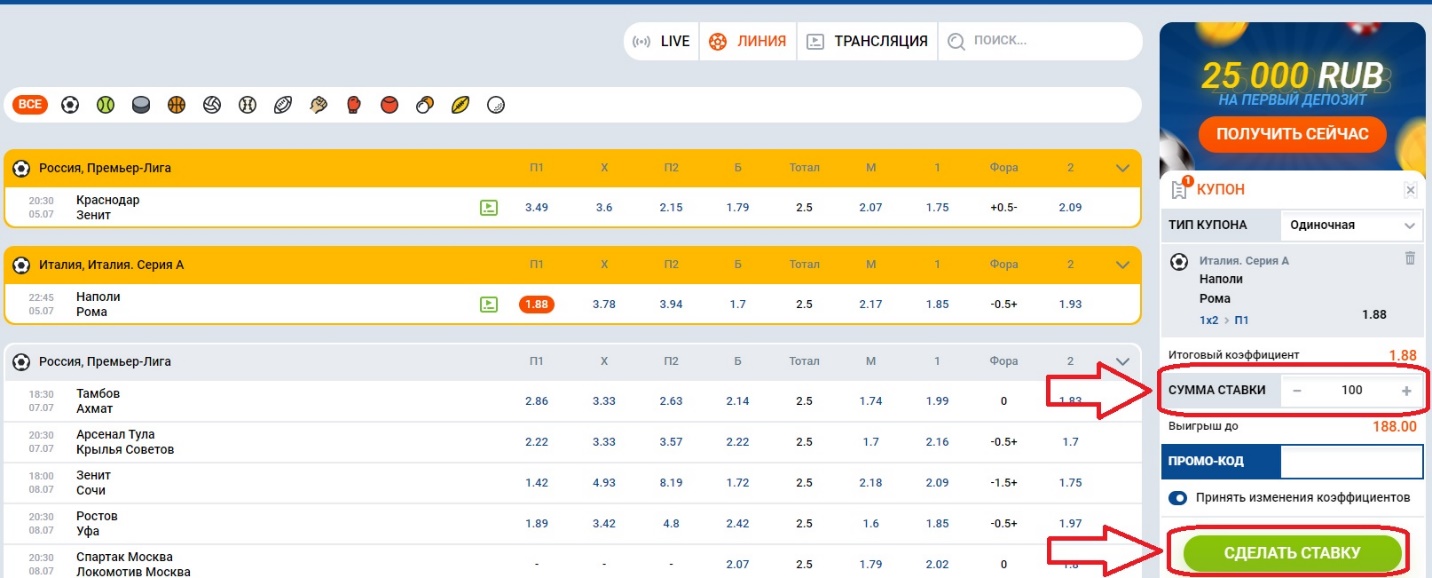

Ставки на спорт

Сейчас предлагаю рассмотреть, как делать ставки на спорт в букмекерской конторе Мостбет когда вы нашли рабочее зеркало и показать, насколько это просто. Нужно лишь следовать инструкциям ниже:

- Выбираем матч и анализируем его, а после того, как закончили, переходим в линию или Live, чтобы найти тот самый матч;

- Как только нашли матч, нажмите на исход, который анализировали и на который хотите сделать ставку;

- Нажав на ставку, она автоматически перейдет в купон, который находится в правой стороне экрана. Здесь нужно будет ввести сумму ставки и нажать на заключение пари.

Вот так легко, просто и быстро мы сделали ставку на матч, а вам останется лишь дождаться окончания поединка, чтобы узнать расчет пари.

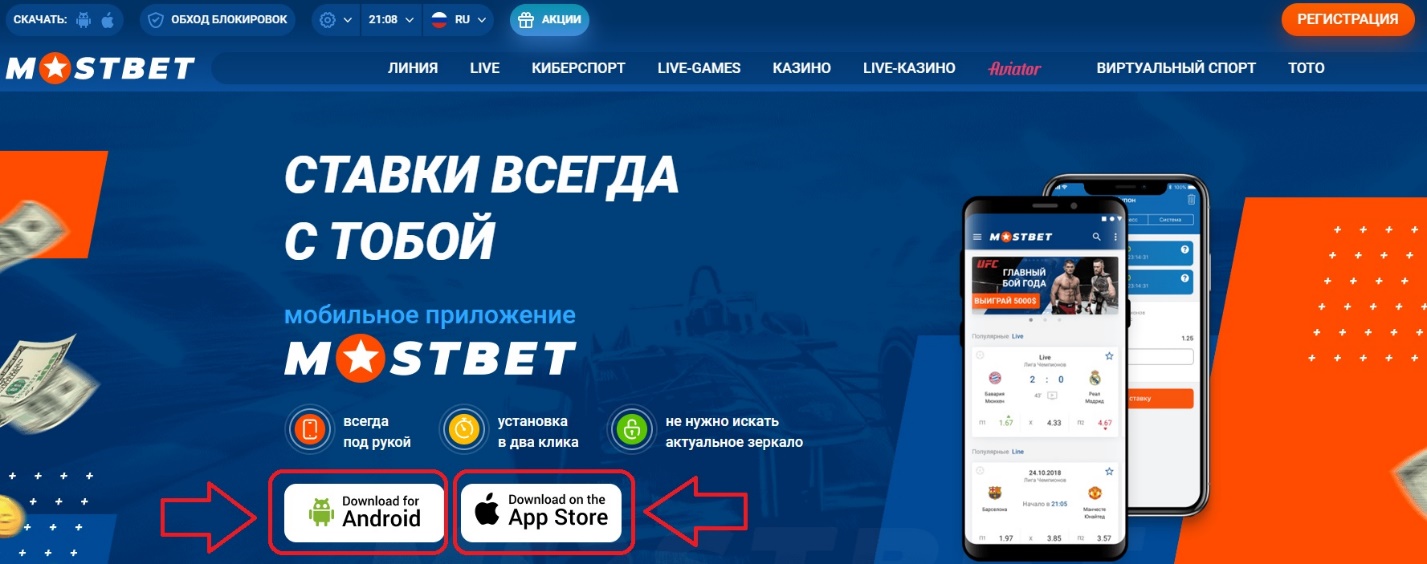

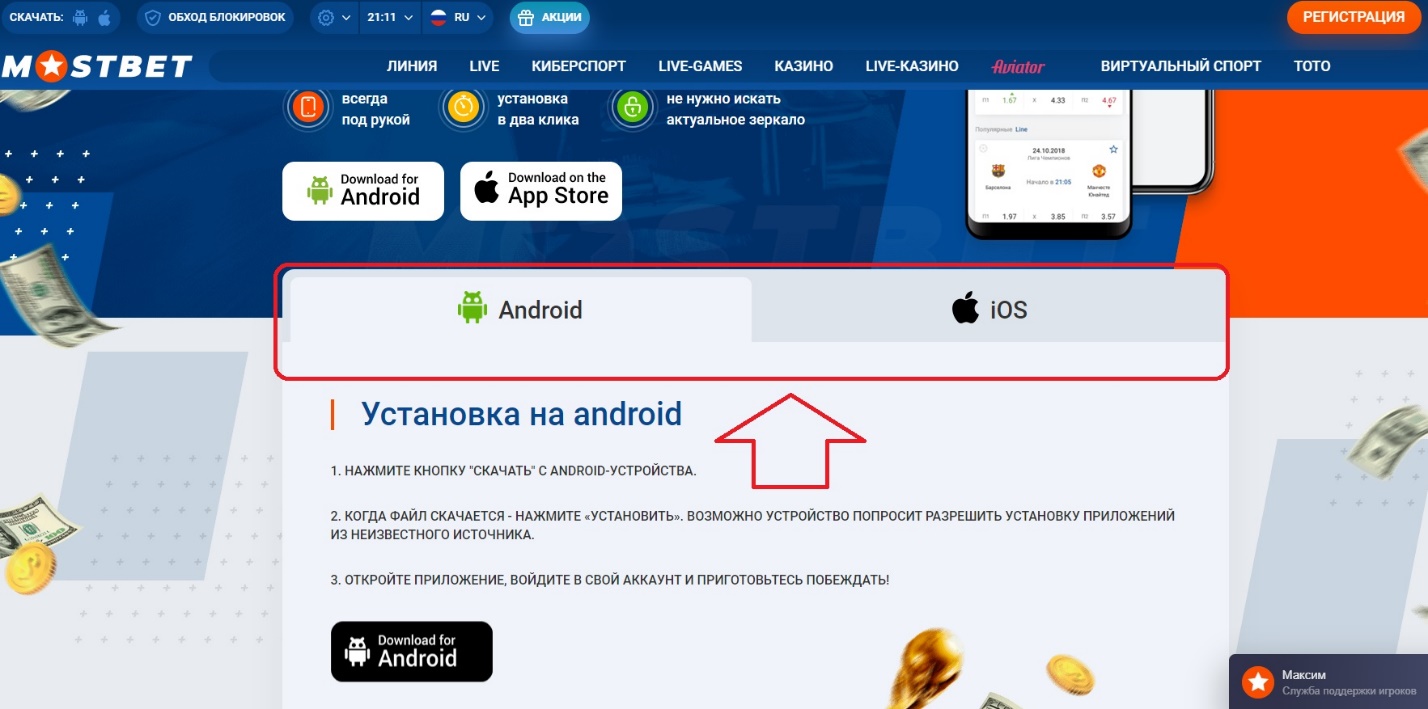

Приложение Mostbet

Кстати, чтобы вам было намного проще делать ставки на спорт, букмекерская контора Мостбет разработала собственный софт. Прямо сейчас, вы можете перейти на сайт букмекера через браузер, который установлен на гаджете и нажать на меню с приложениями.

Здесь доступно приложение Mostbet на Андроид и Айфон. Выбирайте тот софт, который подходит под вашу операционную систему.

Нажав на свою операционку, начнется загрузка установочного файла, а сам букмекер предложит ознакомиться с инструкциями, чтобы правильно поставить на свой гаджет приложение.

Кстати, в приложении Мостбет встроено актуальное и рабочее зеркало компании, которое всегда обновляется. Благодаря этому, вам больше не нужно будет искать зеркала, так как доступ к сайту будет обеспечен на постоянной основе.

Служба поддержки

Служба поддержки БК “Мостбет” работает круглосуточно, без выходных. Связаться со специалистами можно так:

- в лайв-чате на официальном сайте (самый оперативный способ).

- по электронной почте (по вопросам идентификации): [email protected].

- в разделе “Контакты” на сайте (заполнить специальную форму обращения).

- по телефону горячей линии (звонок по РФ бесплатный):

Если произойдет проблема, с который вы не можете справиться самостоятельно, то не стесняйтесь и обратитесь за помощью в службу поддержки букмекерской конторы Mostbet. Сделать это можно через:

- Электронную почту [email protected];

- По телефону горячей линии 8 (800) 302-12-88;

- Через заполнение формы обратной связи в разделе контакты на сайте;

- Через онлайн чат с оператором.

Оператор поможет в любой ситуации, насколько бы тяжелой она не была. Так что, не стесняйтесь и помните, что букмекер всегда рядом.

FAQ

Как зайти на сайт Мостбет через соц. сети?

нажмите на кнопку вход и выбирайте ту социальную сеть, через которую хотите войти. Далее, останется лишь ввести логин и пароль от личной страницы, либо авторизация пройдет автоматически.

Как играть в казино MostBet?

раздел казино находится в главном меню на официальном сайте букмекерской конторы.

Почему не работает официальный сайт?

Все дело в блокировках, которые устраивает РКН из-за разногласий в работе лицензий букмекера и государства.

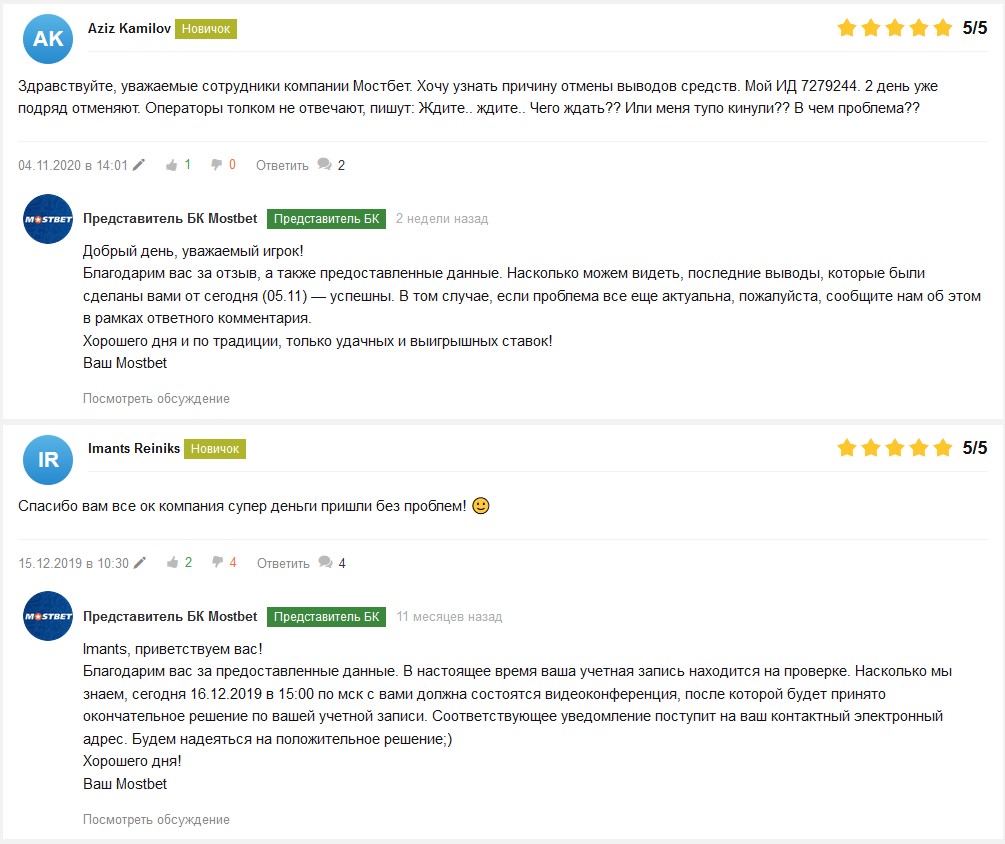

Отзывы о БК Мостбет

Напоследок, хотел бы продемонстрировать каждому из вас отзывы реальных игроков, которые можно найти в интернете, чтобы у вас не возникло сомнений в том, что это действительно достойная компания, которой можно доверять.

Обратите внимание, что на все обращения пользователей отвечает официальный представитель БК Мостбет, и это говорит о том, что компания тщательно следит за своей репутацией и идет на контакт со всеми клиентами, за что можно сказать им большое спасибо.

Как видите, букмекерская контора Mostbet является отличным вариантом для того, чтобы начать делать ставки. Попасть на этот сайт не так трудно, благодаря нашему зеркалу, а вместе с промокодом, можно будет заработать легкие деньги на бонусе за регистрацию.

Надеюсь, вы сделаете правильный выбор и будете ставить только с надежным и проверенным букмекером, коим является букмекерская контора Mostbet.

Несколько раз менял букмекеров, так как кидали с выплатами. В мостбет пока такого не наблюдал, играю 5 месяцев, деньги выводили.

Люблю крутануть слоты в казике, чисто под пиво после работы для развлечения. Получалось в Мостбет иногда выигрывать, в целом пока при своих остался.

В этой конторе уже два года, пока никаких проблем не было, хотя один раз при выводе большой суммы просили пройти верификацию. Думал, что деньги потеряю, так как плохой опыт был, но все необходимые документы предоставил и выплату сделали.

Заключила ставку вв МостБет на довольно большуюсумму, выигрыш составил более 30 тысяч рублей. Деньги пришли сразуже. Я безумно радатому, что нашла новуюту сферу заработка, которая мне близка.

Играю в Мостбет всем доволен, выводил 8 кусков проблем не было.

Радует лайв, он не лагает, обрабатывает ставки быстро, трансляции не лагают. Для меня лайв самое важное по линии не ставлю и в этом плане пока мостбет лучший, пробовал множество контор.

Сочные коэфы, на днях прошёл экспресс с кф 23. Когда прошла последняя ставка, орал на всю квартиру 🙂

Зарегался по совету друга, который более 4 лет ставит. Пока полёт нормальный.

Особо не доверял онлайн букмекеркам, но Мостбет вывел выигрыш уже несколько раз.

Зарегистрировался первые 500 руб проиграл, закинул ещё 500 и получилось раскрутить счёт на 2000 руб. Пока выводить не буду, хочу довести счёт до 10к и потом 5к вывести, а 5к оставить.

Использовал данный промокод при регистрации, смог отыграть бонус. Спасибо!

Зашел по вашей ссылке, вход нормально работает, все данные сохранились. Спасибо.

А если я зайду на зеркало, мне нужна повторная регистрация или я сразу могу делать вход и ставить?

Да, это официальное зеркало, я уже и ставил, и выводил с него.

Перешел по вашей ссылке, выглядит рли так же, как и официальный сайт, а то он у меня почему-то перестал работать.

Чел, там вход такой же, как и на официальном сайте, регистрация не нужна. Мог бы просто попробовать ввести свои данные и проверить)

А почему адрес зеркала не похож на адрес официального сайта? У других я видел, там похожи обычно. Это точно официальное зеркало?

Перешел по ссылке, зеркало выглядит как обычный сайт, сразу разобрался. Спасибо.

Да, это официальное зеркало. Я уже и ставила и выводила с него.

Вроде бы это лицензионная букмекерская контора, но я зашел на официальный сайт, а там нет этой информации. Это другая или я что-то не понял?

Мне больше нравится офшорный букмекер Мостбет. На нем с моих выигрышей не взимаются налоги, а также предлагаются повышенные коэффициенты.

Ввел промокод, получил бонусы. Все отлично, спасибо!

Я правильно понял, что для того, чтобы отыграть бонусы по промокоду, нужно ставить на конкретный коэффициент, причем в несколько раз больше бонуса? А как я это сделаю, если у меня депозит небольшой?

Подтверждаю, что здесь всегда предлагается рабочее зеркало. Я в любой момент могу посетить заблокированный ресурс и совершить спортивную ставку.

Я выбрал данного букмекера из-за простого способа создания аккаунта и щедрых бонусов. Здесь все работает на самом высоком уровне.

Администрация Mostbet предлагает многофункциональный ресурс для клиентов. Я смог быстро во всем разобрать, после чего приступил к совершению спортивных ставок.

При работе с зеркалом Мостбет я не увидел никаких отличий от официального сайта беттинговой площадки. На альтернативном ресурсе предлагается аналогичный функционал.

Благодаря зеркалу с вашего сайта я смог зайти на офшорный портал Мостбет. Спасибо за публикацию работающих альтернативных ссылок.

Я пошел более простым путем обхода блокировок. Я скачал приложение на смартфон Андроид и забыл о том, что в России блокируется сайт офшорного букмекера.

Букмекер предлагает очень щедрый бонус. Я смог его быстро отыграть, чем увеличил свои возможности в области беттинга.

На официальном сайте МостБет все идеально, а вот в пунктах приема есть недочеты. Поэтому я и перешел полностью на онлайн. Ставлю 4 из 5.

Несколько раз тут ставил и все было норм, кэффы Мостбет радуют.